This post may contain affiliate links. We may earn money or products from the highlighted keywords or companies or banners mentioned in this post.

Labor Day marks the end of summer — and the kickoff of the fall travel season. This week in travel stats we got a look at where your clients could be headed next.

The Bahamas Tops Labor Day Travel Destinations

This weekend, the Bahamas could be topping the list of popular Labor Day travel destinations, according to a new study by travel loyalty company Switchfly.

The data was obtained through Switchfly’s platform which powers Orbitz, Expedia, and many other travel booking companies.

“What we really have here is a short-list of the best beaches that are easy to reach from the major U.S. hubs,” said Daniel Farrar, CEO of Switchfly, “Cancun is about a four-hour flight from LAX and Aruba is a four-hour flight from JFK. You’ve got people from the West Coast flying to Mexico, people from the East Coast flying to the Bahamas, and people from all over the U.S. are flying to Florida because it’s close and it’s inexpensive.”

Farrar continued: “It’s no surprise to see New York and Las Vegas on the list, as they are top travel destinations year-round. Number 11 on the list – Santiago, Chile – is a bit more difficult to explain. With September temperatures in the mid-60s and travel times from any U.S. airport clocking in at well over 14 hours, it’s not the warm weather or the cost of airfare that sees an uptick in Labor Day travel to this South American city. It must be the Shiraz.”

Source: Switchfly

New York Tops Domestic Destinations for Fall Travel

Also this week, a new study by Travel Leaders Group took a look at where clients could be headed for the rest of the fall.

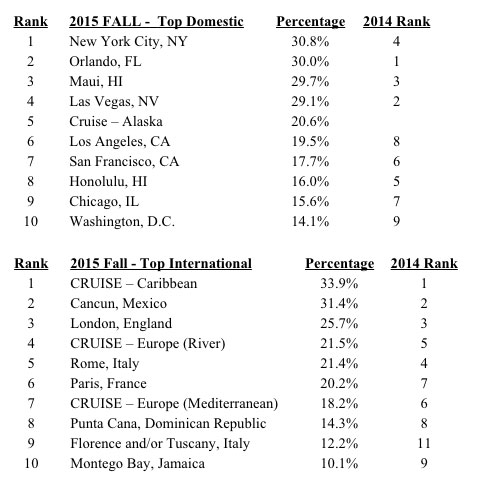

According to a nationwide survey of travel agents, New York City ranks as the top domestic destination for travel during the remainder of 2015 – a spot typically held by Orlando or Las Vegas. Internationally, Americans are headed on Caribbean cruises, first and foremost, while the rest of the top five is rounded out by: Cancun, Mexico; London, England; European river cruises; and Rome, Italy. Travel Leaders Group travel agents also provided insights into Greece travel, top types of trips and destinations for Millennials – with honeymoon travel leading the list, and more than 87 percent of respondents indicated year-to-date comparable bookings are better than or the same as last year.

This survey was conducted by Travel Leaders Group from August 3 – August 25, 2015, and includes responses from 1,152 U.S.-based travel agency owners, managers, and frontline travel agents from the flagship Travel Leaders brand, along with those affiliated with Travel Leaders Group’s Cruise Specialists, Nexion, Protravel International, Results! Travel, Travel Leaders Corporate, Tzell Travel Group and Vacation.com units.

Travel Leaders also shared insights in how bookings are trending versus last year, what’s next for Millennial travelers and the latest on how the recent financial crisis in Greece is impacting travel.

Hotel Fees to Top $2.47 Billion in 2015

This week also saw the release of new insights regarding hotel trends. According to a report by the NYU School of Continuing and Professional Studies (NYSCPS), hotel fees, which already hit a record $2.35 billion in 2014, will rise again to $2.47 billion in 2015.

NYSCPS said the forecast increase for 2015 reflects a combination of approximately 3.0 percent more occupied hotel rooms than in 2014, more charging of fees and surcharges, and higher amounts charged, for a total increase of approximately 5 percent.

Hotel fees and surcharges have increased every year except brief periods following 2001 and 2008 that saw a decline in lodging demand.

The above amounts are estimated based on selected interviews with industry executives and corporate travel executives, analysis of industry financial data, press releases, and information available on hotel and brand websites, NYSCPS said.

Source: NYU School of Continuing and Professional Studies

Hotel Revenue to Grow 5.9 Percent in 2016

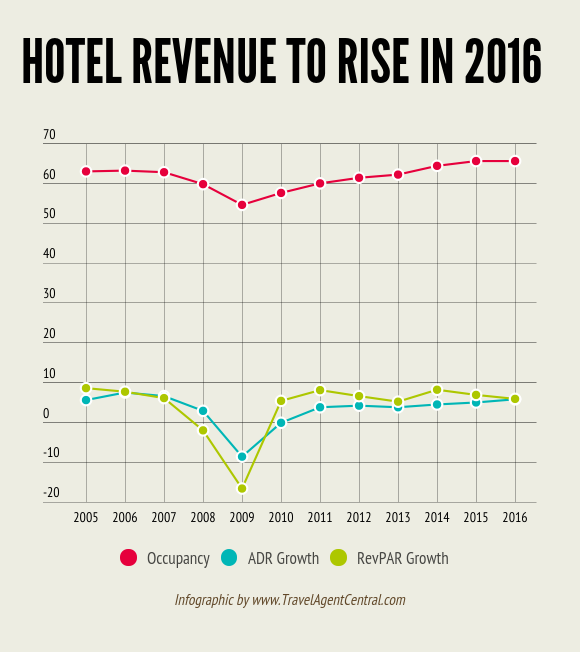

Hotel revenue is also set to grow, according to a separate report by PwC US. The company is forecasting that average daily rate (ADR) will drive revenue per available room (RevPAR) increases in a more meaningful way through the second half of 2015 and into 2016. Recent performance of the lodging industry has generally met industry expectations, and during the second quarter, ADR growth drove RevPAR increases to a larger degree than in recent quarters, PwC US said.

PwC finds that lodging demand trends in the U.S. have been robust, with both transient and group travel occupancy levels increasing 1.4 percent and 1.5 percent, respectively, during the first half of the year, contributing to peak occupancy levels for U.S. hotels. PwC expects this positive momentum in demand to continue for the remainder of 2015, supporting a RevPAR increase of 6.9 percent in 2015. In 2016, PwC expects RevPAR to grow 5.9 percent, driven by ADR.

The estimates from PwC are based on a quarterly econometric analysis of the lodging sector, using an updated forecast released by Macroeconomic Advisers, LLC in July, and historical statistics supplied by STR and other data providers. Macroeconomic Advisers expects real gross domestic product (GDP) to increase 2.0 percent in 2015, followed by a 2.9 percent increase in 2016, measured on a fourth-quarter-over-fourth-quarter basis.

Based on this analysis and recent demand trends, PwC expects industry occupancy in 2015 to reach levels not seen since 1981, driven by a combination of strong demand momentum and a still-controlled supply environment. As industry occupancy peaks, average daily rate growth is expected to become more meaningful, as the effects of the recent rise in the value of the U.S. dollar wane, giving operators more pricing power, especially in certain gateway markets.

In 2016, supply growth is expected to accelerate to 2.0 percent per this analysis, with the increase in available hotel rooms exceeding, albeit slightly, the long-term average of 1.9 percent for the first time since 2009. As a result, while occupancy levels are expected to begin to stabilize, these peak levels coupled with the absence of this year’s slowdown from the U.S. dollar is expected to support an average daily rate-driven RevPAR increase of 5.9 percent.

Source: www.pwc.com/US